Chief executive officer

"Good business leaders create a vision, articulate the vision, passionately own the vision, and relentlessly drive it to completion."

Overview

| Chief executive officer | |

|---|---|

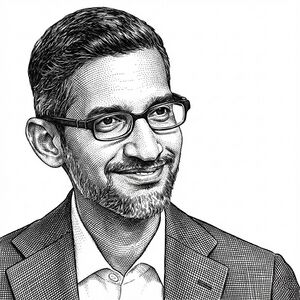

Sundar Pichai, CEO of Alphabet Inc. | |

| Synonyms | Managing director (MD); President |

| Organizational placement | |

| Function | General management |

| Seniority level | Highest-ranking executive (C-Suite) |

| Reports to | Board of directors |

| Direct reports | Chief financial officer; Chief operating officer; Executive committee; Functional heads |

| Mandate and metrics | |

| Core responsibilities | Corporate strategy; Capital allocation; Risk management; Team leadership; Stakeholder representation |

| Key decisions | Strategic pivots; Major capital expenditures; Executive appointments; Mergers and acquisitions |

| Key metrics | Share price performance; Return on capital; Revenue growth; ESG targets |

| Activity sector | Public and private corporations |

| Skills and education | |

| Competencies | Strategic judgment; Financial acumen; Crisis management; Communication |

| Education | Business administration; Finance; Law; Engineering |

🌐 Chief executive officer (CEO) is the highest-ranking executive in many corporations, responsible for major corporate decisions, overall strategy, and the performance of the management team under the oversight of a board of directors.[7][8] In large listed companies the CEO often serves as the main link between directors and employees, translating board-approved strategy and risk appetite into plans, budgets, and targets for the organization.[9]

📊 Capital and control. Modern corporate structures usually separate ownership and control: dispersed shareholders supply capital, directors represent their interests, and the CEO and executive team run day-to-day operations within the boundaries the board sets.[10][11] This arrangement lets companies scale across countries and industries but creates recurring tensions among shareholders, independent directors, senior management, and employees over time horizons, risk, and the distribution of economic gains.

What the CEO role is and where it comes from

🏭 From owner-manager to professional. In early industrial firms, founders or family owners typically directed operations themselves, combining the roles of investor, director, and manager in one person.[11] As enterprises expanded into railroads, steel, energy, and mass manufacturing, ownership dispersed across many investors, and boards began to delegate operational authority to professional managers with specialized skills, out of which the modern CEO role emerged.

🏛️ Separation of ownership and management. Analyses of corporate development in the 20th century describe a structural shift in which legal owners of shares relinquished direct control to professional managers in exchange for liquidity and limited liability.[10][12] Shareholders bear financial risk and elect directors, directors appoint and oversee the CEO, and the CEO leads the management team; this chain of delegation underpins contemporary corporate governance systems in many market economies.

⚖️ Relationship with the board and shareholders. Boards set broad strategic direction, approve budgets and large transactions, monitor risk, and evaluate the CEO’s performance, while the CEO must supply timely, accurate information and execute agreed plans within delegated authority limits.[9][13] Shareholders typically exert influence indirectly through elections of directors, advisory votes on pay, and engagement with the board, rather than by directing the CEO’s day-to-day decisions.

🔄 Evolution of expectations. Over recent decades, globalization, digital technology, and ESG considerations have widened the CEO’s agenda from internal operations toward cyber risk, climate transition, diversity, and regulatory scrutiny, while activist investors and proxy advisers have increased pressure on boards to justify CEO appointments, strategies, and pay.[14][15] As a result, many CEOs now balance quarterly reporting demands with long-term investments in technology, talent, and reputation, while operating under closer oversight and disclosure requirements than their predecessors.

What CEOs actually do

🧭 Core responsibilities. Boards commonly describe the CEO’s mandate as setting and executing strategy, allocating capital, building and leading the executive team, ensuring effective risk management and internal controls, and representing the company to investors, regulators, and other external parties.[8][13] The CEO is also expected to maintain an organizational culture that supports lawful, ethical, and productive behavior across business units and functions.

📅 Daily and weekly rhythm. Typical CEO schedules mix internal and external work: recurring meetings with direct reports, reviews of financial and operational dashboards, visits to plants or offices, one-on-ones with the board chair, and calls or roadshows with large shareholders, analysts, or lenders.[7] Many CEOs also lead off-site strategy sessions, review succession slates, and sponsor cross-functional projects in areas such as digital transformation, cost programs, or new product launches.

📐 Decision boundaries. CEOs usually approve major strategic choices, large capital expenditures, top executive appointments, and significant restructurings within limits that the board’s delegation frameworks define.[13][15] Boards reserve decisions such as hiring or removing the CEO, endorsing overall strategy, approving major mergers and acquisitions, and setting executive pay, while day-to-day operational decisions—pricing, staffing, and process design—are generally delegated to business unit and functional leaders.

🎯 Objectives and cascading. Each year the CEO and board convert strategy into financial and non-financial objectives, expressed in budgets, revenue and profit targets, risk and compliance thresholds, and sometimes ESG metrics linked to incentive plans.[9][16] The CEO and executive committee then cascade these objectives through key performance indicators, scorecards, and individual goals so that teams in sales, operations, technology, or support functions can translate high-level strategy into concrete work.

The CEO’s leadership architecture

👥 Executive committee and direct reports. CEOs usually rely on an executive committee that brings together the chief financial officer, chief operating officer, heads of major business lines, and leaders of functions such as human resources, legal, technology, risk, and communications.[8][15] The CEO chairs this group, sets its agenda, and uses it to coordinate trade-offs among growth, profitability, risk, and investment across geographies and product lines.

🧵 Middle management as translation layer. Middle managers translate high-level objectives into local budgets, schedules, and processes and feed operational and customer information back up to the executive team.[13] The CEO depends on this layer to identify implementation risks, surface issues that require cross-functional attention, and maintain consistency between stated priorities and daily practices in frontline teams.

📣 Strategy communication. CEOs communicate direction through town halls, internal social networks, written messages, and leadership conferences, often repeating a small set of themes that reflect the board-approved strategy, such as “customer focus,” “cost discipline,” or “safety first.”[9] These messages usually coincide with visible actions—resource shifts, project sponsorships, or changes in meeting content—that signal which initiatives matter most and how success will be measured.

🔍 Reading priorities from structures. Employees can often infer a CEO’s true focus by watching which metrics appear on dashboards, which projects receive incremental funding, which roles report directly to the CEO, and which behaviors receive public recognition or rapid correction. When a CEO creates a chief digital officer role, moves data and analytics into a central function, and gives that leader a seat on the executive committee, the organization receives a clear structural signal that digital capabilities are a core strategic lever rather than a peripheral support activity.

How the CEO impacts employees’ daily reality

💼 Workload and project mix. CEO decisions about strategy and capital allocation influence which projects proceed, which locations expand or contract, and how aggressive cost targets become, directly shaping employees’ workloads, travel, and role definitions. A tilt toward investment in automation or offshoring may reduce repetitive tasks in some units while increasing coordination, change-management, and analytics work in others.

🏢 Culture and informal rules. CEOs influence culture through their visible behaviors, the trade-offs they endorse, and the consequences they impose for misconduct or underperformance; employees pay attention to how leaders treat safety incidents, compliance breaches, and customer complaints as much as to formal value statements.[15][9] Over time, patterns in hiring, promotion, and recognition decisions create informal rules about whether the organization values experimentation, stability, compliance, or speed.

📈 Job security and careers. When a CEO expands a growth business, launches new product lines, or opens new markets, employees may see more internal vacancies, secondments, and international assignments, whereas a shift away from legacy activities can lead to redeployment, retraining, or redundancies in affected units. The CEO’s stance on internal mobility, performance management, and leadership development also influences how employees perceive their long-term prospects inside the firm.

🚨 Crisis behavior and trust. In crises such as recessions, scandals, cyber incidents, or public health shocks, CEOs decide how quickly to communicate, whether to prioritize cash preservation or continued investment, and how to distribute the impact of cost measures between executive compensation, dividends, and staff expenses.[13][15] Transparent explanations of choices, consistent application of criteria, and visible willingness to share sacrifices with employees can support trust, whereas abrupt or opaque decisions can damage it.

📬 Channels for employee voice. Many firms provide formal mechanisms for employees to reach senior leadership—town-hall questions, engagement surveys, ethics hotlines, employee councils, or cross-functional initiatives—alongside informal opportunities such as skip-level meetings or internal collaboration platforms. CEO responses to critical questions, whistleblower reports, or survey results often signal how seriously management takes employee input and how safe dissent feels in practice.

🔁 Transitions between CEOs. CEO changes can trigger strategy reviews, restructuring, and turnover in the executive committee, with knock-on effects for reporting lines and project priorities.[17][18] Employees often watch the new CEO’s first 12 to 18 months—what they visit, whom they promote or exit, which metrics they emphasize—to judge whether the organization’s direction and culture will remain stable or change.

Becoming, evaluating, paying, and removing CEOs

🚀 Paths to the role. Many CEOs have backgrounds in business, engineering, finance, or law and have held profit-and-loss roles, but boards also appoint leaders from functional tracks such as finance or operations when they demonstrate strategic judgment, crisis experience, and ability to attract and retain talent.[8][17] Internal candidates often bring deep knowledge of the company and its stakeholders, while external hires may be chosen to drive change, reposition a portfolio, or reset culture.

🪜 Selection and succession. Governance codes and board-practice surveys describe CEO selection and succession planning as core board responsibilities, with many recommending long-term pipelines, emergency plans, and regular reviews of potential successors.[16][18] Boards typically use a mix of internal performance data, third-party assessments, and external benchmarking, sometimes engaging search firms to compare internal and external candidates before agreeing a shortlist and making an appointment decision.

📏 Evaluation and oversight. Boards usually assess the CEO against a combination of financial metrics—revenue growth, profitability, cash generation, and return on capital—and non-financial indicators such as strategy execution milestones, risk management, employee engagement, and regulatory relationships.[15][9] Annual reviews often link these assessments to bonus and long-term incentive decisions and can lead to course corrections in strategy, management composition, or the CEO’s own development priorities.

💰 Compensation structure and levels. Large listed companies typically pay CEOs through a mix of base salary, annual cash bonuses, and long-term equity incentives such as restricted stock or performance share units, with variable components tied to multi-year performance metrics and share-price outcomes.[8][19] Studies of S&P 500 firms report that median CEO compensation packages reached about $17.1 million in 2024, an increase of roughly 9–10% from the previous year, with most value delivered through stock awards rather than salary.[20][21][19]

⚖️ Pay debates and constraints. The growth of CEO compensation and large gaps between CEO and median employee pay—often in the range of 200:1 or higher in U.S. large-cap indices—have prompted criticism from unions, some investors, and advocacy groups, which argue that pay structures can encourage excessive risk-taking and contribute to inequality.[22][23] Boards respond with pay-for-performance rationales, enhanced disclosure, and shareholder “say-on-pay” votes, while adjusting performance metrics and vesting conditions to emphasize long-term value rather than short-term share-price fluctuations.[19]

🧨 Removal and negotiated exits. Boards may remove or pressure a CEO to resign when financial results lag peers, strategic initiatives fail, major risk or conduct issues arise, or working relationships between the CEO and directors deteriorate.[18][17] In many cases, the CEO’s employment contract specifies severance, accelerated vesting terms, and post-employment restrictions such as non-compete or non-solicitation clauses, leading to negotiated exits sometimes described as “golden parachutes” when payouts are large relative to performance.[20]

CEOs beyond the company

🌐 Public representation and ecosystems. CEOs often act as the public face of their companies in earnings calls, investor conferences, media interviews, and major customer or supplier negotiations, shaping external perceptions of strategy, risk, and culture.[7][9] Many also participate in industry associations, business councils, or economic forums that coordinate positions on sector-specific regulation, trade, taxation, or labor-market issues.

🏛️ Engagement with policy and regulation. Through consultations, comment letters, and meetings with policymakers, CEOs and their teams advocate for regulatory frameworks, accounting rules, and infrastructure policies that they argue support competitiveness and investment in their sectors.[15] Their input can influence technical details of implementation even when governments set the overall direction, and boards sometimes review the company’s public-policy agenda and lobbying activities as part of their governance remit.

🌱 ESG commitments and social issues. As environmental, social, and governance (ESG) topics have become more prominent in investor and regulatory expectations, many CEOs now sign climate pledges, diversity and inclusion commitments, or data-privacy principles and integrate these into strategy, risk management, and reporting.[24][25] Some also lead or fund philanthropic initiatives or foundations focused on education, health, or community development, often aligned with corporate or personal priorities.

🤝 Stakeholder expectations and CEO activism. Supporters of “CEO activism” contend that leaders should speak out on issues such as climate change, racial equity, or democratic institutions when these affect employees, customers, or long-term enterprise value, while critics argue that CEOs should avoid partisan positions and concentrate on core business performance.[24] These debates influence how boards oversee the CEO’s external role and how investors, employees, and other stakeholders interpret public statements relative to internal practices and resource allocation.

🧭 Effects on employees and reputation. Employees may feel pride when a CEO’s public commitments on topics such as sustainability or inclusion align with internal policies and behaviors, or skepticism when external messaging diverges from lived experience on pay, workload, or representation.[25] The perceived fit between what CEOs say externally and what they prioritize internally affects recruitment, engagement, and retention, as well as the company’s standing with regulators, communities, and business partners.

See also

- Corporate governance

- Board of directors

- Chief financial officer

- Chief operating officer

- Corporate culture

- Executive compensation

- Shareholder activism

- Environmental, social, and corporate governance

References

- ↑ "P.F. Drucker (Peter Drucker): Modern Management Theory & MBO". Business.com. Retrieved November 28, 2025.

- ↑ "Management is doing things right; leadership is doing the right things". Rock Solid Business Development. Retrieved November 28, 2025.

- ↑ "Speed, Simplicity, Self-Confidence: An Interview with Jack Welch". Harvard Business Review. Retrieved November 28, 2025.

- ↑ "Leadership Insights from Jack Welch". Scale Up Growth. Retrieved November 28, 2025.

- ↑ "Satya Nadella email to employees on first day as CEO". Microsoft. Retrieved November 28, 2025.

- ↑ "Popular Quotes by Satya Nadella on Technology and Transformation". Ian Khan. Retrieved November 28, 2025.

- ↑ 7.0 7.1 7.2 "Chief Executive Officer (CEO): Roles and Responsibilities vs. Other C-Suite Roles". Investopedia. Retrieved November 28, 2025.

- ↑ 8.0 8.1 8.2 8.3 8.4 "CEO (Chief Executive Officer) - Overview, Responsibilities, Characteristics". Corporate Finance Institute. Retrieved November 28, 2025.

- ↑ 9.0 9.1 9.2 9.3 9.4 9.5 9.6 "What Is a Chief Executive Officer (CEO)? A Complete Guide". BoardCloud. Retrieved November 28, 2025.

- ↑ 10.0 10.1 "Berle and Means Discuss Corporate Control". EBSCO Research Starters. Retrieved November 28, 2025.

- ↑ 11.0 11.1 Berle, Adolf A.; Means, Gardiner C. (1932). The Modern Corporation and Private Property. New York: The Macmillan Company.

- ↑ Cheffins, Brian R. "Is Berle and Means Really a Myth?" (PDF). European Corporate Governance Institute. Retrieved November 28, 2025.

- ↑ 13.0 13.1 13.2 13.3 13.4 "Role of chief executive officer (CEO) or managing director (MD)" (PDF). Australian Institute of Company Directors. Retrieved November 28, 2025.

- ↑ "The Rise and Fall (?) of the Berle-Means Corporation". Harvard Law School Forum on Corporate Governance. August 6, 2018. Retrieved November 28, 2025.

- ↑ 15.0 15.1 15.2 15.3 15.4 15.5 15.6 "Board Roles and Responsibilities: Everything You Need to Know". Ascot International. July 14, 2025. Retrieved November 28, 2025.

- ↑ 16.0 16.1 "How the Best Boards Approach CEO Succession Planning". Harvard Law School Forum on Corporate Governance. September 20, 2021. Retrieved November 28, 2025.

- ↑ 17.0 17.1 17.2 "The Never-Ending Story: CEO Succession Planning". Harvard Law School Forum on Corporate Governance. June 11, 2023. Retrieved November 28, 2025.

- ↑ 18.0 18.1 18.2 "More and Better Options: Strengthening Long-Term CEO Succession Planning". Harvard Law School Forum on Corporate Governance. June 2, 2025. Retrieved November 28, 2025.

- ↑ 19.0 19.1 19.2 "CEO and Executive Compensation Practices in the Russell 3000 and S&P 500". Harvard Law School Forum on Corporate Governance. June 8, 2025. Retrieved November 28, 2025.

- ↑ 20.0 20.1 "CEO pay rose nearly 10% in 2024 as stock prices and profits soared". AP News. Associated Press. May 29, 2025. Retrieved November 28, 2025.

- ↑ "How AP and Equilar calculated CEO pay". AP News. Associated Press. May 29, 2025. Retrieved November 28, 2025.

- ↑ "Executive Paywatch 2025". AFL–CIO. Retrieved November 28, 2025.

- ↑ "Median US CEO pay hits record $16.8 million on soaring stock awards". Reuters. April 24, 2025. Retrieved November 28, 2025.

- ↑ 24.0 24.1 "The CEO's ESG Dilemma". PwC. December 6, 2022. Retrieved November 28, 2025.

- ↑ 25.0 25.1 "The Role of the CEO in Driving ESG". The Conference Board. December 2, 2022. Retrieved November 28, 2025.